The Best Guide To Financial Advisor Victoria Bc

The 25-Second Trick For Private Wealth Management copyright

Table of ContentsInvestment Representative Can Be Fun For EveryoneAll about Independent Investment Advisor copyrightAn Unbiased View of Independent Investment Advisor copyrightUnknown Facts About Lighthouse Wealth ManagementThe Basic Principles Of Independent Financial Advisor copyright The Best Guide To Lighthouse Wealth Management

“If you're buying a product or service, say a tv or a computer, you'll would like to know the specifications of itwhat are the parts and just what it is capable of doing,†Purda details. “You can contemplate purchasing economic information and help in the same way. People need to know what they're getting.†With monetary information, it's vital that you just remember that , the product is not securities, stocks and other investments.It’s things like cost management, planning pension or reducing debt. And like getting a personal computer from a dependable company, consumers need to know they truly are getting financial information from a dependable professional. Certainly Purda and Ashworth’s most fascinating conclusions is just about the fees that monetary planners cost their customers.

This held real regardless the cost structurehourly, percentage, possessions under administration or predetermined fee (for the study, the buck property value costs had been alike in each instance). “It still boils down to the value idea and anxiety in the people’ part they don’t understand what these include getting in trade of these costs,†says Purda.

The smart Trick of Retirement Planning copyright That Nobody is Discussing

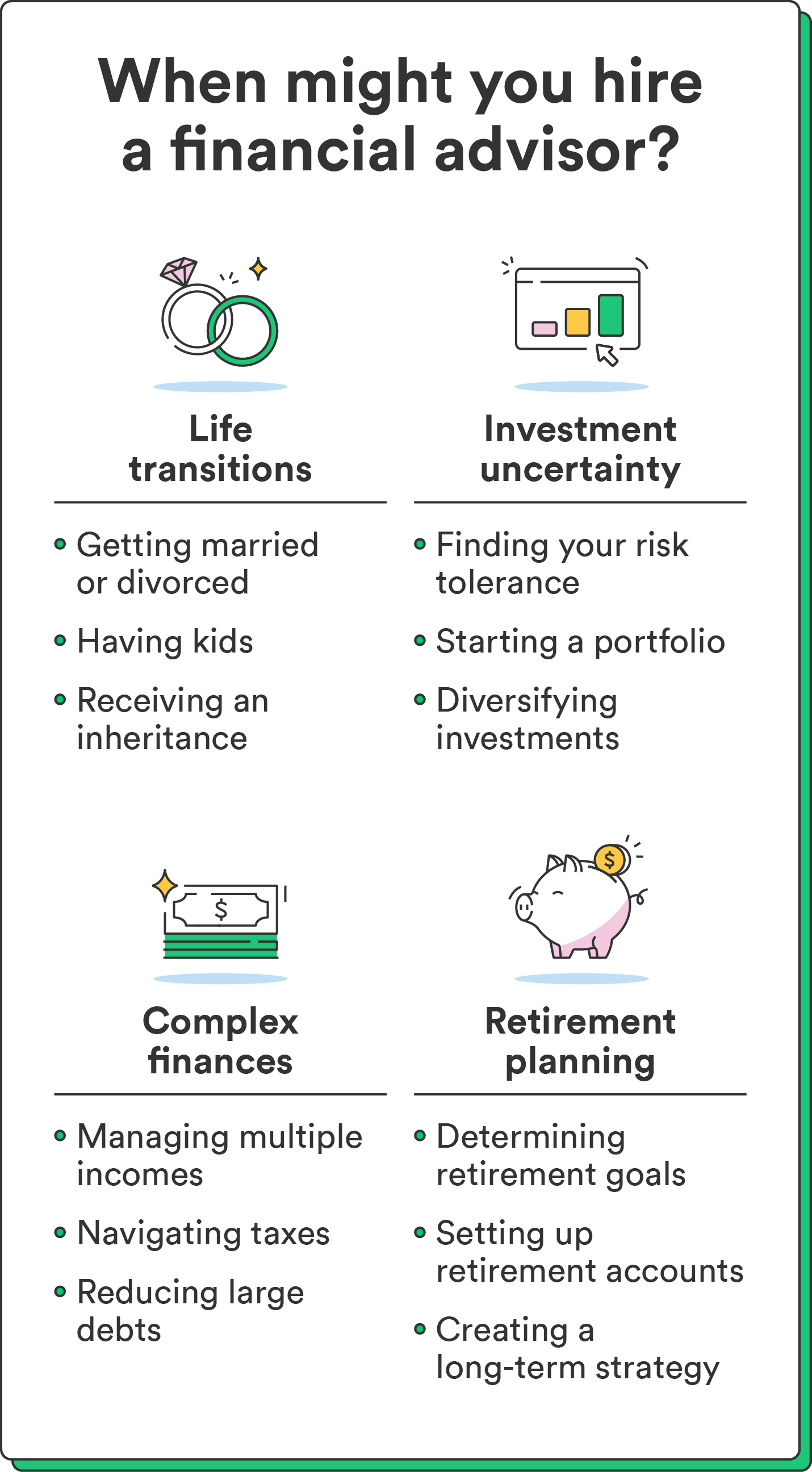

Hear this informative article When you listen to the phrase financial consultant, exactly what one thinks of? Many people consider a professional who can provide them with monetary advice, specially when you are looking at trading. That’s outstanding place to start, although it doesn’t color the complete photo. Not near! Monetary analysts enables people with a lot of additional money goals too.

A monetary specialist assists you to create wealth and protect it for the longterm. They can approximate your own future economic needs and plan approaches to stretch the your retirement cost savings. They're able to additionally counsel you on when you should begin tapping into personal safety and ultizing the amount of money in your your retirement records to abstain from any nasty charges.

The Ia Wealth Management Diaries

They could guide you to find out exactly what common resources tend to be right for you and explain to you simple tips to manage and work out more of one's financial investments. They may be able additionally guide you to understand the threats and exactly what you’ll should do to obtain your targets. A seasoned financial investment pro will help you remain on the roller coaster of investingeven when your financial investments get a dive.

They are able to give you the advice you'll want to make an agenda so you're able to ensure that your desires are carried out. And you also can’t place a cost label throughout the satisfaction that include that. In accordance with a recent study, an average 65-year-old couple in 2022 requires about $315,000 saved to cover health care expenses in pension.

Facts About Investment Consultant Revealed

Since we’ve reviewed exactly what monetary analysts would, let’s dig into the various sorts. Here’s an excellent principle: All financial planners tend to be economic experts, not all advisors tend to be coordinators - https://www.cybo.com/CA-biz/lighthouse-wealth-management_50. An economic coordinator concentrates on assisting people produce intentions to attain long-term goalsthings like starting a college fund or preserving for a down cost on property

How do you know which monetary expert is right for you - https://www.cgmimm.com/professional-services/lighthouse-wealth-management-a-division-of-ia-private-wealth? Below are a few things you can do to ensure you’re hiring suitable person. What do you do if you have two bad choices to pick? Effortless! Discover more possibilities. The more solutions you really have, a lot more likely you will be to manufacture a beneficial choice

Everything about Independent Financial Advisor copyright

Our wise, Vestor plan can make it easy for you by showing you as much as five monetary analysts who are able to serve you. The best part is, it's totally free attain associated with an advisor! And don’t forget to come calmly to the meeting ready with a list of concerns to ask to help you ascertain if they’re a great fit.

But tune in, just because an expert is smarter compared to the ordinary bear doesn’t provide them with the ability to show what direction to go. Occasionally, experts are full of themselves simply because they convey more degrees than a thermometer. If an advisor begins talking-down to you personally, it is for you personally to suggest to them the doorway.

Understand that! It’s essential that you and your economic expert (anyone who it winds up being) take alike web page. You desire a consultant who's got a long-term investing strategysomeone who’ll convince that keep investing constantly if the market is upwards or down. retirement planning copyright. top article In addition, you don’t desire to use a person that forces one to purchase a thing that’s too dangerous or you are unpleasant with

The Single Strategy To Use For Private Wealth Management copyright

That mix gives you the variation you need to successfully spend for all the long term. Because study economic advisors, you’ll most likely encounter the definition of fiduciary task. All this means is actually any consultant you hire has got to work in a fashion that benefits their particular customer and never their very own self-interest.